From its all-time high of 5,667 on July 16th, the S&P 500 declined 8.5% to 5,186 on August 5th. Market volatility measures rose, and high-profile stocks such as Microsoft and NVIDIA declined by more than the average. Several catalysts have been cited: a general sense of a weakening US economy, stubbornly high interest rates, and the previous outperformance of the mega-cap technology-related stocks. In addition, market observers have noted the unwinding of a “yen carry trade” following the Bank of Japan’s move to raise its interest rates on July 31st.

The Japanese yen carry trade[1] involves borrowing money in Japanese yen, and investing it in other currencies or assets, such as the US dollar. The strategy seeks to exploit the differential between Japan's and other countries' rates. However, the Japan carry trade also exposes investors to significant exchange rate risk, as any appreciation of the yen against the other currencies can wipe out the profits from the rate difference. This has led to a surge in the value of the yen against other currencies, as well as a decline in the prices of the assets that were funded by the carry trade. The unwind of the trade has also contributed to the depreciation of the US dollar, as the demand for the US dollar has decreased. The totality of this trade is estimated to be worth several hundred billion dollars, and its unwinding could have significant implications for short-term volatility across global markets.

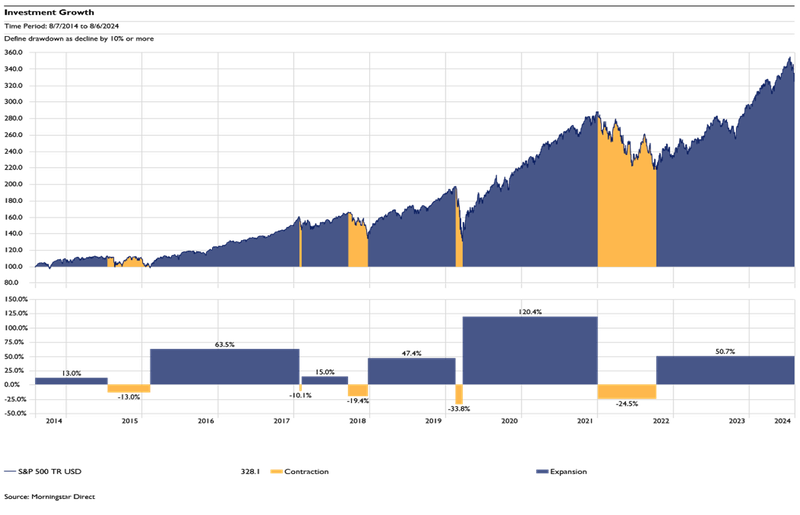

As shown in the graph below, market movements, even sudden, of this magnitude are not unusual. The S&P 500 has declined by 10% or more five times in the last decade[2].

Another lesson in the graph is that the market has recovered to higher levels after each decline. As a group, investors have a very poor history of reacting on a short-term basis to volatility and attempting to time an exit and re-entry.

Long-term asset allocation presumes that higher return assets (like stocks) come with higher volatility. Investors need a risk posture that is appropriate for their time horizon and liquidity needs. Bolton advises plan sponsors to adopt a strong governance process that encourages a consistent, long-term outlook.

[1] A carry trade is a type of investment strategy that involves borrowing money in a currency with a low interest rate and using it to buy assets in a currency with a higher interest rate. The investor hopes to profit from the difference between the two interest rates, as well as from the appreciation of the higher-yielding currency. However, this strategy also carries significant risks, such as exchange rate fluctuations, political instability, and sudden changes in monetary policy. Therefore, a carry trade is not suitable for novice investors who may not have enough knowledge or experience to manage these risks.

[2] A flash crash is a sudden and dramatic drop in the price of a stock, index, commodity, or currency within a very short period of time, usually caused by a combination of technical glitches, algorithmic trading, and market panic. A flash crash can erase billions of dollars of market value in minutes and trigger circuit breakers that halt trading temporarily. Flash crashes are often followed by a quick recovery, but they can also have lasting effects on investor confidence and market regulation