IRS Notice 2024-2 was released on December 20, 2023 (earlier than its name implies), bringing guidance on twelve provisions of SECURE 2.0 that are or will soon be effective. About half of these items are of interest to most retirement plan sponsors, while a few apply primarily to smaller employers.

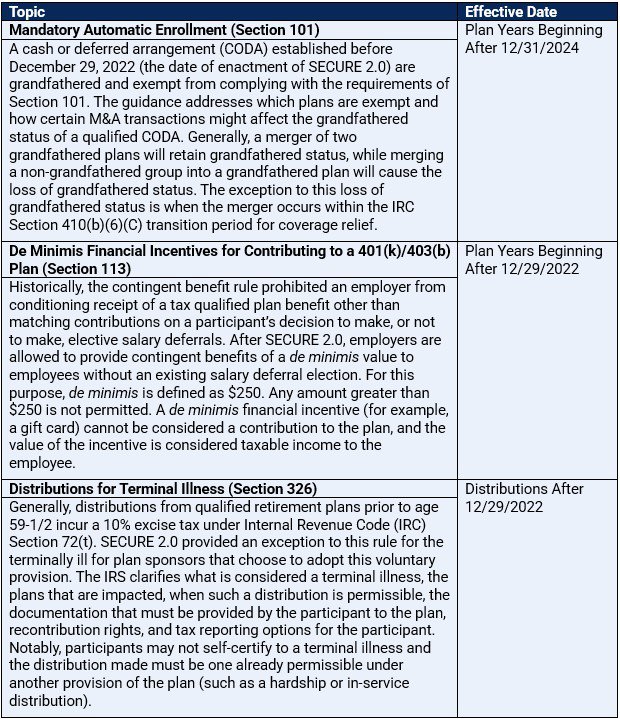

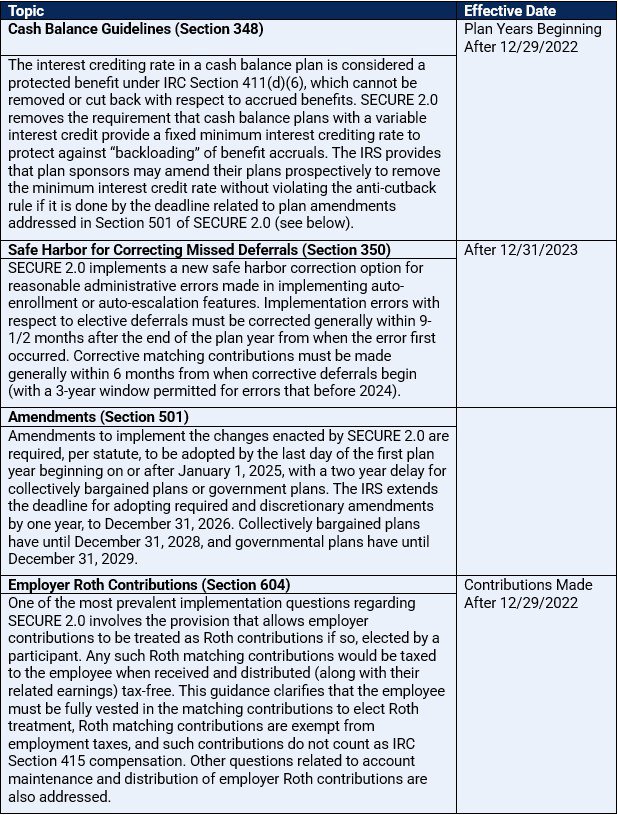

The following tables summarize the guidance provided by the IRS.

Additional Q&As cover topics primarily applicable to small employers, including:

- Small Employer Start-Up Costs Credit (Section 102)

- Small Employer Military Spouse Credit (Section 112)

- Increased Contribution Limits for SIMPLE Plans (Section 117)

- Replacing SIMPLE IRAs with Safe Harbor 401(k) Plans (Section 332)

- SIMPLE and SEP Roth IRAs (Section 601)

Contact a Bolton consultant if you have questions about any of these new requirements.