By Zack Fritz, Sage Policy Group

There’s much to like about the economy heading into 2025. Employers have added jobs in each of the past 47 months, and job growth has actually accelerated slightly since September. The unemployment rate, while higher than one year ago, has held steady over the second half of 2024 and remains low by historical standards at 4.2%. Despite the cumulative effects of inflation, consumers continue to power growth. Spending at retail stores and restaurants is up 3.8% over the past twelve months, the largest year-over-year increase since December 2023.

That’s the good news. The bad news is that inflation has reaccelerated over the past few months. While the PCE Price Index, the Fed’s preferred measure of inflation, is up just 2.4% over the past year, core measures of inflation (exclude food and energy prices due to volatility) suggest price increases have been stubborn during the second half of 2024.

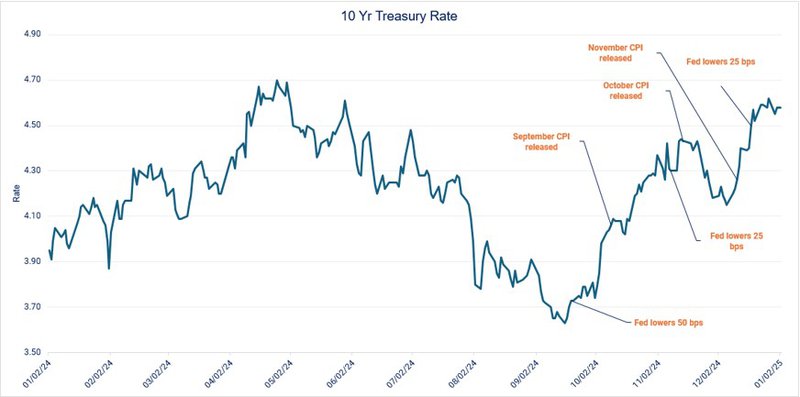

As a result, the outlook on interest rates has deteriorated in recent weeks. The Federal Reserve cut the target range of the federal funds rate at their December meeting, yet actual borrowing costs surged in the aftermath. The staff projections by the Fed now expect just two 25 basis point rate cuts in 2025, down from four expected cuts in their September projections. That, along with remarks by Fed chair Jerome Powell, sent bond yields soaring.

The Fed has slashed the target range of the federal funds rate by 100 basis points since the middle of September, but average mortgage rates on a 30-year fixed have risen from about 6.1% to 6.7% since that initial cut. Put simply, inflation expectations are having a greater effect on borrowing costs than the federal funds rate as seen in the chart below.

And the recent uptick in price increases isn’t the only reason inflation expectations have worsened in recent months. President-elect Trump has suggested two policies that would put significant upward pressure on prices: tariffs and mass deportations. Of course, it’s unclear if he intends to implement those tariffs, or if he’s simply using them as a bargaining tool to obtain trade concessions. If immigration restrictions are enacted, the result is likely to be a tighter labor supply and, all else equal, faster wage growth.

The upshot is that the economy is looking at higher for longer interest rates heading into 2025. As a result, the housing market will remain in a state of paralysis, at least until borrowing costs subside, and certain commercial real estate segments will continue to struggle.

Even so, the economy carries ample momentum into the new year. Consumers have powered growth in recent years, and they will continue to do so as long as unemployment remains low. There will also be tailwinds from the incoming presidential administration’s deregulation efforts, and rising business confidence suggests that hiring will remain brisk in the early months of the year.

The upshot: despite policy uncertainty and questions regarding inflation and the path of interest rates, the economy should continue to expand at a healthy pace throughout the coming year.