Like all of you, we are watching the progress of COVID-19 and considering its implications. While we have no knowledge of the disease itself, we have a few thoughts on the financial effects:

- It’s Real - What began as a local problem has spread quickly; each day it appears more likely that US communities will be affected.

- It Will Have an Impact - The potential for disruption of economic activity appears very real, and near- term economic growth and corporate earnings may be dampened.

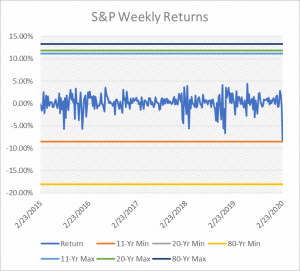

- Markets are Responding Rapidly - By Thursday’s close, the S&P 500 had recorded the fastest “correction” ever, losing over 10% in six trading days. Markets respond poorly to uncertainty; technology makes large trading volumes possible. As of Friday’s close, the S&P 500 was down 12.0% from its high, and was down 8.3% year-to-date in 2020. In the week of September 29, 2008, the S&P 500 declined 18%.

But there is a bull market in bonds – the 10 year Treasury yield fell to 1.13%, a record low, raising bond prices. This provides some offset to the loss of value in stocks, but the magnitude isn’t as great, and it constrains future returns. We are concerned that a bond yield under 1.0% would signal low growth to investors.

Stock market corrections are a normal occurrence. The last one was in the fourth quarter of 2018. And moves of this speed and magnitude have to be driven by institutional investors, and likely by higher volume strategies, rather than by individuals selling.

- There Will be a Recovery – We are uncertain as to the full impact of COVID-19 on the markets and economy, however history shows that there will be a recovery. Recoveries are just as difficult to predict as a downturn or correction. We believe that long-term institutional investors with sound asset allocation strategies should, in general, avoid tactical short-term trading; especially during extreme market events such as these.We also remind them that their long-term (5 - 10 year) outlook is not impacted by short- term market events. As shown in the charts below, the stock market has weathered other crises and risen over time, because eventually the growth of the economy and of corporate earnings is reflected.

Benjamin Graham, the author of the classic textbook Security Analysis, referred to this pattern of short-term volatility and long-term growth when he said: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Please reach out to a Bolton Investment Consultant for more information.